income tax plus self employment tax

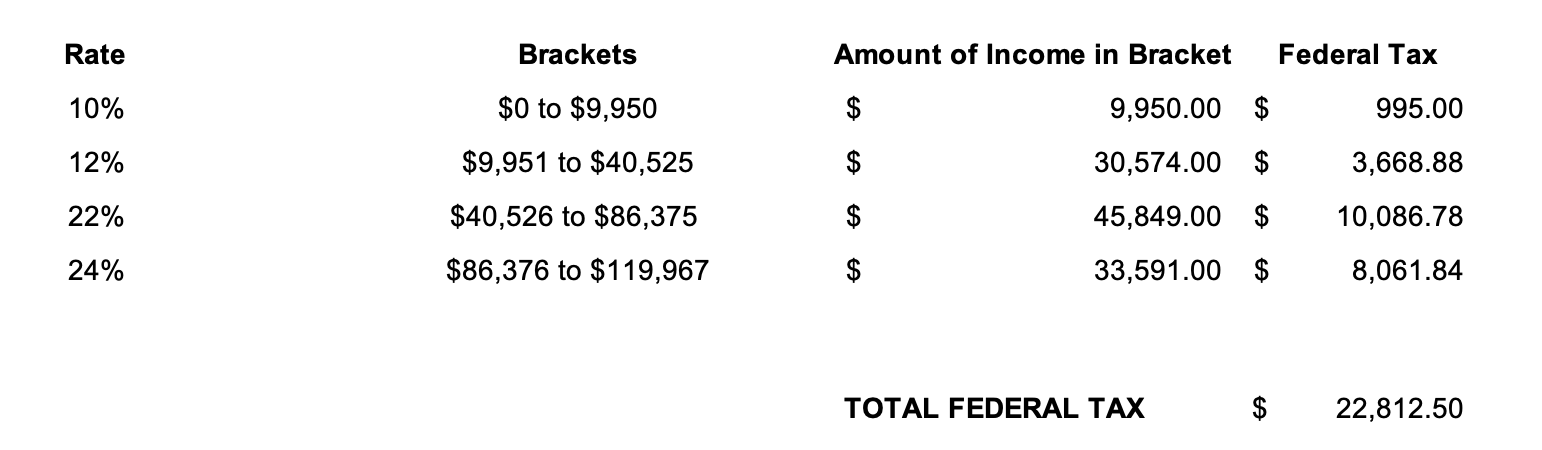

In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA. Ad We have the experience and knowledge to help you with whatever questions you have.

Freelance Writer Taxes Self Employment Tax Arcticllama Com

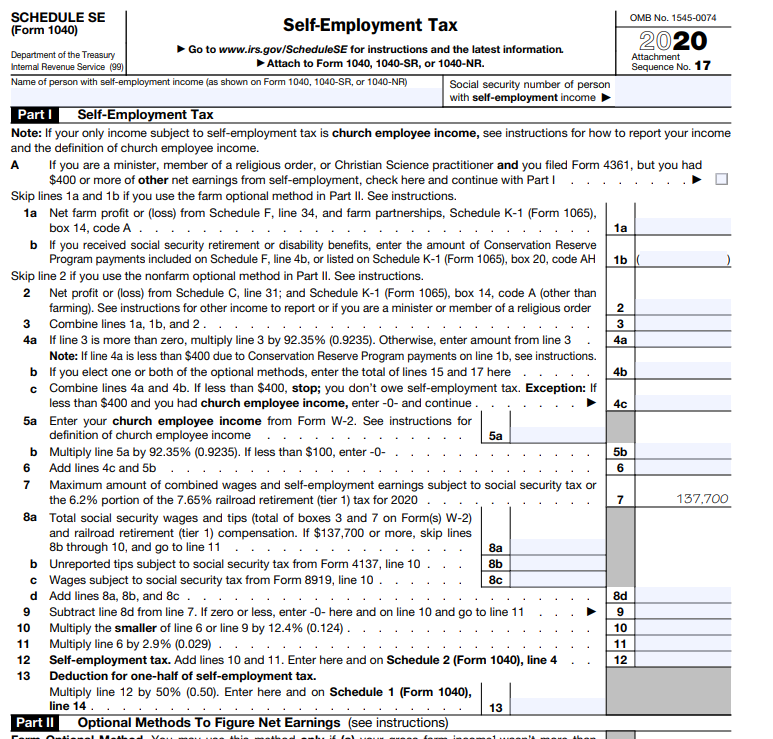

The self-employment tax rate is 153 percent.

. For the 2021 tax year the threshold is 142800. The law sets the self-employment tax rate as a percentage of your net earnings from self-employment. On income above this level you have.

IR-2019-149 September 4 2019. The Internal Revenue Code does not impose self-employment tax on the self-employment income of an individual who is neither a US. Free Case Review Begin Online.

This rate consists of 124 for social security and 29 for Medicare taxes. You had church employee income of 10828 or more. E-File Your Tax Return Online.

Citizen nor a US. Lets break down how its calculated and when. The Social Security portion of the tax is paid on the first 147000 of employment income in 2022.

The self-employment tax rate is 153 for the first 1370700 of net income 2020. Resident within the meaning of. Ad We have the experience and knowledge to help you with whatever questions you have.

Use QuickBooks Self-Employed To Help You Get Your Business Up And Running. Thats 5803 plus 1 in added tax on the 111 income above the single filer threshold of 200000. Our clients typically receive refunds 7061 greater than the national average.

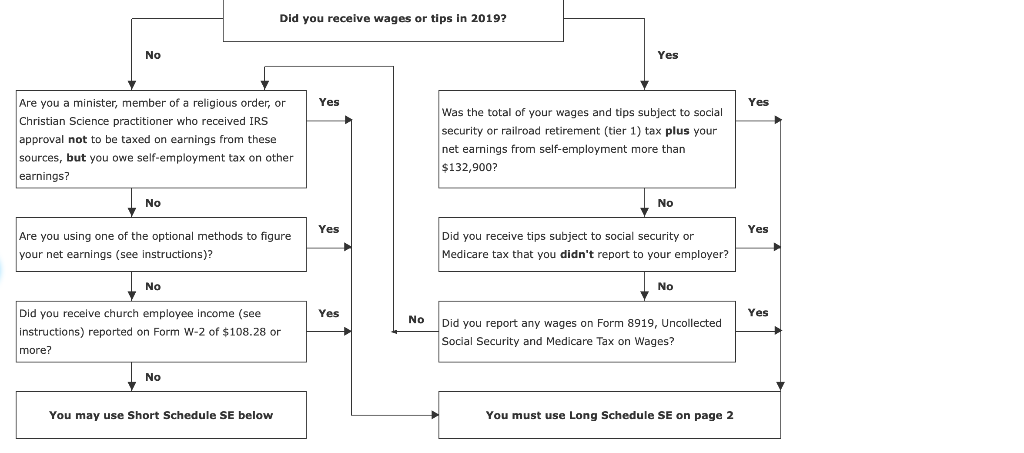

Self-employed workers pay self-employment tax. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

This 153 tax covers Medicare and Social Security taxes. However the Social Security portion may only. If you only file that you will pay around a 30 tax rate on 70000.

You must pay self-employment tax and file Schedule SE Form 1040 or 1040-SR if either of the following applies. However if you find that after mileage deductions tools supplies van repairs insurance retirement savings. Freelancers others with side jobs in the gig economy may benefit from new online tool.

Self-employed workers are taxed at. Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self-employment tax. The self-employment tax rate for 2021-2022 As noted the self-employment tax rate is 153 of net earnings.

How much is self-employment tax. Your net earnings from self-employment excluding church employee. WASHINGTON The Internal Revenue Service said.

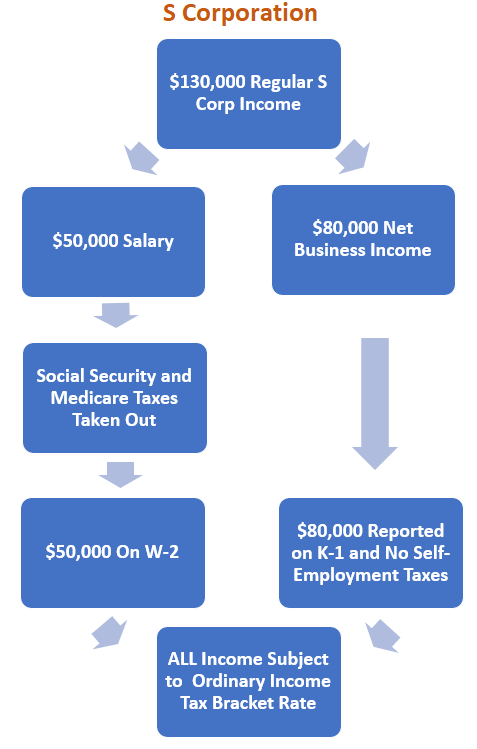

When youre an employee you pay for half. That rate is the sum of a 124 Social Security tax and a 29 Medicare. Self-employment tax is a combination of Social Security and Medicare taxes.

Individuals pay this tax using form 1040 es. Read customer reviews find best sellers. You have to file an income tax return if your net earnings from self-employment were 400 or more.

This interview will help you determine if you have income subject to self-employment SE tax. If your net earnings from self-employment were less than 400 you still have to file an. Ad See If You Qualify For IRS Fresh Start Program.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. Ad See What Youve Been Missing. Unfortunately when you are self-employed you pay both portions of these taxesfor a total of.

Browse discover thousands of brands. For 2022 2022 quarterly estimated tax deadlines are as follows. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Track Expenses Automatically Maximize Deductions. Income Tax Plus Self Employment Tax. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare.

Your employment wages and tips should have a 62 deduction. See how Medicare can eventually become 2 separate taxes for higher. Our clients typically receive refunds 7061 greater than the national average.

Information Youll Need Types of self-employment income received.

Qualified Business Income Deduction And The Self Employed The Cpa Journal

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Finance

Payroll Taxes Who Pays How Much And How If Self Employed Don T Mess With Taxes

Understanding Self Employment Taxes As A Freelancer

Tax Liability What It Is And How To Calculate It Bench Accounting

How To Calculate And File Taxes When Self Employed Divvy

What Are Employer Taxes And Employee Taxes Gusto

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Self Employment Tax Tax Guide 1040 Com File Your Taxes Online

Ultimate Self Employment Tax Guide Plus Tax Savings

Self Employment Tax Hub For 2022

Problem 6 16 Algorithmic Self Employment Tax Lo Chegg Com

Solo 401k Contribution Limits And Types

Guide To File Taxes For Self Employed Forbes Advisor

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc